All Categories

Featured

Table of Contents

But before drawing cash out of a MYGA early, consider that one of the significant benefits of a MYGA is that they expand tax-deferred. Chris Magnussen, licensed insurance representative at Annuity.org, explains what a taken care of annuity is. A MYGA supplies tax obligation deferment of interest that is intensified on a yearly basis.

It's like spending in an Individual retirement account or 401(k) yet without the contribution limitations.

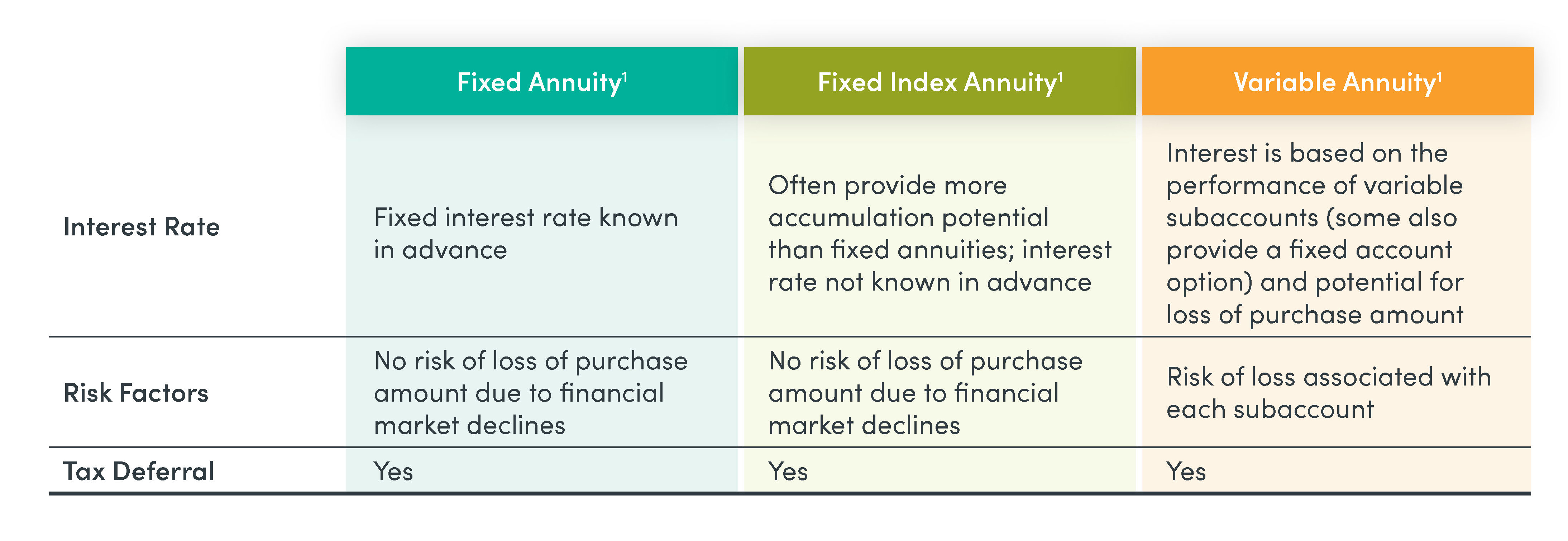

This tax benefit is not one-of-a-kind to MYGAs. It exists with conventional fixed annuities. MYGAs are a sort of dealt with annuity. The main distinction between traditional set annuities and MYGAs is the amount of time that the agreements assure the fixed rate of interest. MYGAs guarantee the rates of interest for the entire duration of the agreement, which could be, for example, ten years.

So, you may acquire an annuity with a seven-year term yet the price may be ensured just for the initial 3 years. When individuals talk of MYGAs, they normally compare them to CDs. Discover exactly how to secure your savings from market volatility. Both MYGAs and CDs deal assured price of return and a guaranty on the principal.

Average Annuity Commission

Contrasted to investments like supplies, CDs and MYGAs are much safer but the price of return is reduced. They do have their differences. A CD is released by a financial institution or a broker; a MYGA is a contract with an insurer. A CD is FDIC-insured; a MYGA is not insured by the federal government, however insurance provider should belong to their state's guaranty association.

A CD may have a reduced interest price than a MYGA; a MYGA might have extra fees than a CD. CD's may be made offered to financial institutions and liens, while annuities are shielded against them.

Provided the traditional nature of MYGAs, they may be better for customers closer to retirement or those that choose not to be subjected to market volatility. immediate fixed income annuity rates. "I turn 62 this year and I actually desire some type of a fixed price as opposed to bothering with what the stock market's going to perform in the following one decade," Annuity.org consumer Tracy Neill stated

For those that are looking to outpace inflation, a MYGA may not be the ideal economic approach to fulfill that goal. Various other types of annuities have the potential for greater benefit, however the risk is greater, too.

Better recognize the actions entailed in purchasing an annuity. They use moderate returns, they are a secure and reliable investment choice.

How Long Do Annuity Payments Last

No-load Multi-Year Guaranteed Annuities (MYGAs) on the RetireOne platform deal RIAs and their clients security against losses with a guaranteed, fixed rate of return. These services are interest-rate delicate, but may offer insurance features, and tax-deferred development. They are favored by conservative investors seeking rather predictable outcomes.

3 The Cash money Out Alternative is an optional attribute that must be elected at contract problem and topic to Internal Revenue Code limitations. Not available for a Qualified Longevity Annuity Agreement (QLAC). Your life time income repayments will certainly be reduced with this choice than they would certainly lack it. Not offered in all states.

An annuity is a contract in which an insurance business makes a collection of income repayments at routine intervals in return for a premium or costs you have paid. Annuities are commonly purchased for future retired life revenue. Only an annuity can pay a revenue that can be ensured to last as long as you live.

One of the most typical kinds of annuities are: single or several costs, immediate or deferred, and fixed or variable. For a single costs contract, you pay the insurer only one repayment, whereas you make a collection of payments for a several premium (typical annuity returns). With an instant annuity, income settlements start no behind one year after you pay the costs

Typically, what these rates will certainly be is completely as much as the insurance policy firm. The current rate is the price the firm chooses to credit score to your contract at a specific time. The company will guarantee it will not alter rates for a particular amount of time. The minimal guaranteed rates of interest is the most affordable rate your annuity will certainly make.

Some annuity contracts apply different rate of interest prices to each premium you pay or to costs you pay throughout various time periods. types of annuity in insurance. Various other annuity agreements may have two or more built up worths that fund various benefit choices.

Starting An Annuity

Under existing government legislation, annuities get unique tax obligation therapy. Earnings tax obligation on annuities is postponed, which suggests you are not taxed on the interest your money gains while it stays in the annuity.

Many states' tax obligation legislations on annuities follow the government regulation. Numerous states have legislations that give you a set number of days to look at the annuity agreement after you purchase it.

The "free look" duration ought to be prominently mentioned in your contract. Make sure to review your contract thoroughly during the "free look" period. You need to think concerning what your objectives are for the money you place into any annuity. You need to think of just how much risk you want to take with the cash too.

Terms and problems of each annuity contract will vary. Compare info for comparable agreements from a number of firms. If you have a details concern or can not get solutions you require from the agent or business, call the Division.

The purchaser is often the annuitant and the person to whom routine repayments are made. There are two basic type of annuity agreements: instant and deferred. An immediate annuity is an annuity contract in which repayments begin within year of the day of purchase. The immediate annuity is bought with a solitary premium and regular settlements are normally equal and made month-to-month, quarterly, semi-annually or every year.

Routine repayments are postponed until a maturity day stated in the contract or, if earlier, a day picked by the owner of the contract. One of the most typical Immediate Annuity Contract payment choices consist of: Insurance company makes routine payments for the annuitant's life time. An option based upon the annuitant's survival is called a life contingent alternative.

Retirement Annuity Fund Definition

There are two annuitants (called joint annuitants), generally spouses and routine payments continue till the fatality of both. The revenue settlement quantity might proceed at 100% when just one annuitant lives or be reduced (50%, 66.67%, 75%) throughout the life of the enduring annuitant. Periodic payments are created a given time period (e.g., 5, 10 or 20 years).

Some prompt annuities give inflation defense with periodic rises based upon a set rate (3%) or an index such as the Consumer Cost Index (CPI). An annuity with a CPI adjustment will start with lower settlements or need a higher initial costs, yet it will certainly offer at least partial security from the danger of inflation.

Income repayments stay constant if the investment efficiency (nevertheless fees) equates to the assumed investment return (AIR) mentioned in the contract - principal fixed annuities. If the investment efficiency goes beyond the AIR, repayments will certainly raise. If the investment efficiency is less than the AIR, repayments will certainly decrease. Immediate annuities typically do not allow partial withdrawals or offer cash money abandonment advantages.

Such persons must look for insurance providers that utilize low-grade underwriting and take into consideration the annuitant's health condition in determining annuity revenue repayments. Do you have sufficient monetary resources to meet your revenue needs without buying an annuity?

Scudder Annuities

For some alternatives, your wellness and marital status may be taken into consideration. A straight life annuity will provide a greater month-to-month revenue payment for a provided premium than life contingent annuity with a duration particular or reimbursement function. Simply put, the cost of a specific income settlement (e.g., $100 each month) will be greater for a life contingent annuity with a period specific or refund function than for a straight life annuity.

An individual with a dependent partner may want to take into consideration a joint and survivor annuity. A person worried about getting a minimum return on his or her annuity costs may desire to consider a life contingent option with a period particular or a reimbursement function. A variable immediate annuity is usually chosen to keep pace with rising cost of living during your retired life years.

A paid-up deferred annuity, also commonly referred to as a deferred income annuity (DIA), is an annuity contract in which each costs settlement purchases a fixed buck income advantage that begins on a specified date, such as an individual's retired life date. The contracts do not maintain an account worth. The premium cost for this product is much less than for an immediate annuity and it enables a person to keep control over the majority of his/her other possessions throughout retirement, while securing longevity security.

Each premium repayment acquired a stream of earnings. The company might take full advantage of the staff member's retirement advantage if the agreement did not offer for a fatality advantage or cash money surrender benefit.

Single Premium Annuity Definition

Many contracts permit withdrawals below a specified degree (e.g., 10% of the account value) on a yearly basis without abandonment cost. Build-up annuities typically provide for a money payment in the event of fatality prior to annuitization.

Table of Contents

Latest Posts

Exploring Fixed Index Annuity Vs Variable Annuity A Closer Look at How Retirement Planning Works Defining What Is Variable Annuity Vs Fixed Annuity Advantages and Disadvantages of Variable Annuities V

Decoding Variable Annuity Vs Fixed Indexed Annuity Key Insights on Fixed Vs Variable Annuity Pros Cons What Is Annuities Variable Vs Fixed? Benefits of Variable Vs Fixed Annuity Why Variable Annuity V

Breaking Down Variable Annuity Vs Fixed Annuity A Closer Look at Pros And Cons Of Fixed Annuity And Variable Annuity What Is Indexed Annuity Vs Fixed Annuity? Pros and Cons of Fixed Interest Annuity V

More

Latest Posts